Nvidia warns that China sales will ‘decline significantly’

Nvidia Corp. investors gave a cool reaction to its latest quarterly report, which blew past average analysts’ estimates but failed to satisfy the loftier expectations of shareholders who have bet heavily on an artificial intelligence boom.

Revenue in the current period will be about $20 billion, the world’s most valuable chipmaker said Tuesday in a statement. Though that topped the average Wall Street prediction of $17.9 billion, some projections reached as high as $21 billion.

After sliding as much as 6.3% in late trading, the shares settled down to a decline of about 1%.

While Nvidia posted another quarter of impressive growth, some investors were clearly anticipating more. They have poured money into the stock this year—sending it up 242%—on the hopes that the AI industry will continue to bring explosive sales gains for Nvidia. That means Nvidia shares were priced at a level that required an absolutely perfect outcome, analysts have said.

Setting aside the outsized expectations, “Nvidia’s results continue to be astounding,” Wolfe Research analyst Chris Caso said in a note to clients. The numbers are particularly impressive given that US restrictions on China are hurting sales, he said. Moreover, Nvidia announced new chips designed for China on Tuesday that could help that market rebound, he noted.

Nvidia shares had closed at $499.44 in New York on Tuesday before the report. The company has been the best-performing stock on the Philadelphia Stock Exchange Semiconductor Index this year, sending its valuation to more than $1.2 trillion.

In fact, Nvidia’s market capitalization is now more than $1 trillion bigger than that of rival Intel Corp., which until recently was the world’s largest chipmaker.

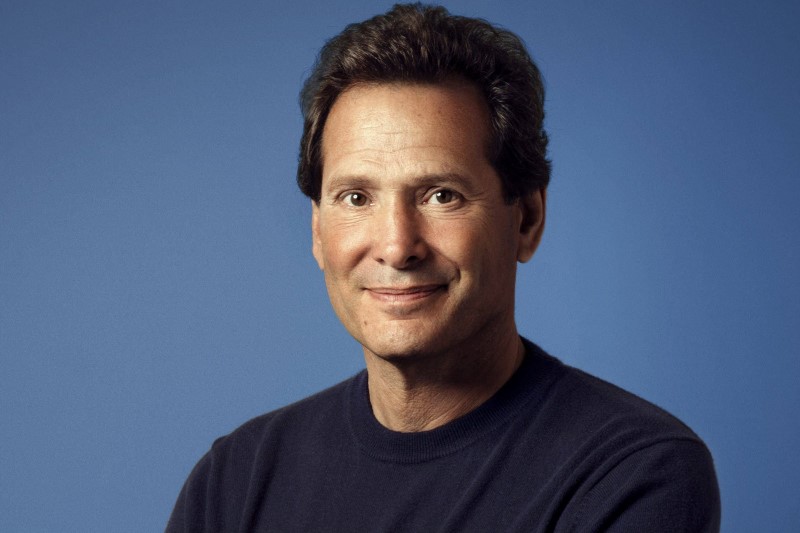

Nvidia Chief Executive Officer Jensen Huang has parlayed a prowess in graphics chips into a leading role in what he calls accelerated computing. The company’s processors, which crunch more data by performing calculations in parallel, have become the go-to tool for training AI services.

In the fiscal third quarter, which ended Oct. 29, revenue more than tripled to $18.1 billion, the company said. Profit was $4.02 a share, minus certain items. Analysts had predicted sales of about $16 billion and earnings of $3.36 a share.

Nvidia’s data center division, the star performer in its operations, had $14.5 billion of revenue, up 279% from the same period a year earlier. The company’s personal computer unit, meanwhile, has rebounded from an industrywide slowdown. Its revenue rose 81% to $2.86 billion.

Nvidia’s success in selling AI chips to companies such as Microsoft Corp. and Alphabet Inc.’s. Google has also made it a target. Microsoft unveiled its own in-house AI processor last week, following a similar effort by Amazon.com Inc.’s AWS. This quarter, Advanced Micro Devices Inc. also will debut a competitor to Nvidia called the MI300. But Nvidia isn’t standing still. It recently unveiled a successor to its prized H100 chip dubbed the H200, and it will be available early next year.

Another threat to Nvidia’s business has come in the form of US curbs on exports to China, the largest market for chips. The Biden administration has restricted the sale of some of Nvidia’s best products on national security grounds.

The US government recently updated its rules governing such exports in October, aiming to make the restrictions harder to circumvent. Nvidia said that the changes won’t affect its sales for now, given the insatiable demand for its products elsewhere. But the requirements are forcing it to rejigger operations and could have an impact down the road.

Nvidia reiterated on Tuesday that the rules didn’t have “a meaningful impact” last quarter. But China and other areas affected by the curbs have accounted for about a quarter of its data center revenue. “We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions,” the company said.

Chief Financial Officer Colette Kress said that US rules require licenses on some exports and advanced notification for other types of chips when shipping to China and some countries in the Middle East. The company is working with customers in those regions to try to secure permission to ship some of its products and on “solutions” that won’t trigger restrictions.

The fourth-quarter drop in China, “though not concerning for the near term, will likely be an area of investor focus,” Bloomberg Intelligence analysts Kunjan Sobhani and Oscar Hernandez Tejada said in a note.

Nvidia is working on some new chips that won’t trigger export restrictions, Kress said. They will appear in the coming months, but won’t likely help results in the current period, she said. It’s too early and there are too many factors involved to make predictions on how such products may affect future revenue, she said.

Guidance in the fourth quarter would have been higher absent the new rules on China shipments, she said.

Huang, meanwhile, pushed back strongly on questions about whether the company’s data center business was reaching peak growth. Nvidia is adding more supply and the expanding use of AI hardware—by software providers, governments and corporate customers—gives him confidence that demand will continue to go up.

“I absolutely believe that data center can grow through 2025,” he said.

Nvidia, based in Santa Clara, California, said it’s spending more on employees after raising pay and hiring new staff. Operating expenses rose 13% from a year ago, and is up 10% from the prior period.

The company also is spending more to look after workers in Israel.

“We are monitoring the impact of the geopolitical conflict in and around Israel on our operations, including the health and safety of our approximately 3,400 employees in the region who primarily support the research and development, operations, and sales and marketing of our networking products,” Nvidia said. “Our operating expenses in the third quarter of fiscal 2024 include expenses for financial support to impacted employees and charitable activity.”

AI has been the hottest topic for tech investors this year, and every major company has talked up its capabilities in that area. But Nvidia is one of the few businesses making serious money from the trend, which has accelerated since the public debut of OpenAI’s ChatGPT in November 2022. That tool helped show the potential of generative AI to a broader audience.

Source link